Health Insurance and

Risk Management systems

Risk Management

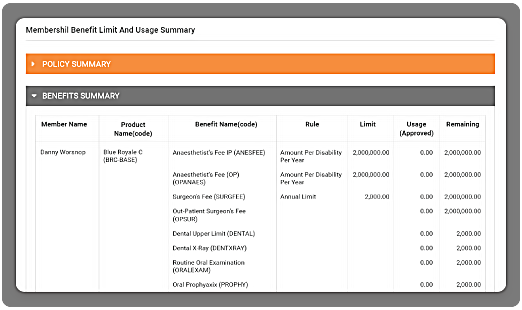

Omni allows real-time control of products and benefits that allows the insurer to:

Key Features

- Make manageable actuarial decisions rapidly with relevant and up-to-date information

- Understand, report and control utilisation of benefits down to member level

-

Control benefits through flexible product configuration allowing tighter limit control - Omni can control limits by:

Time - day, week, month, year By benefit available - Provide a framework where TPAs operate the same system enabling insurer to outsource administration but retain the control of risk

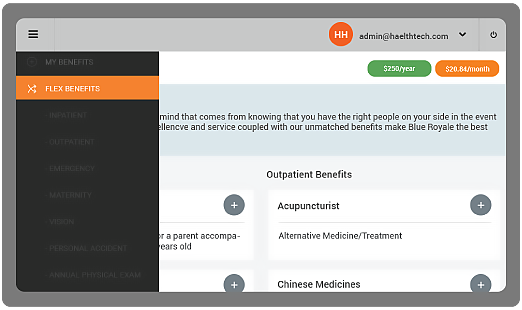

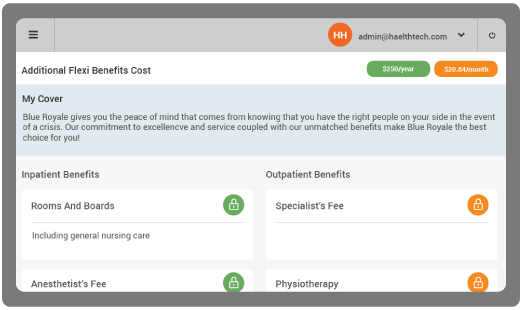

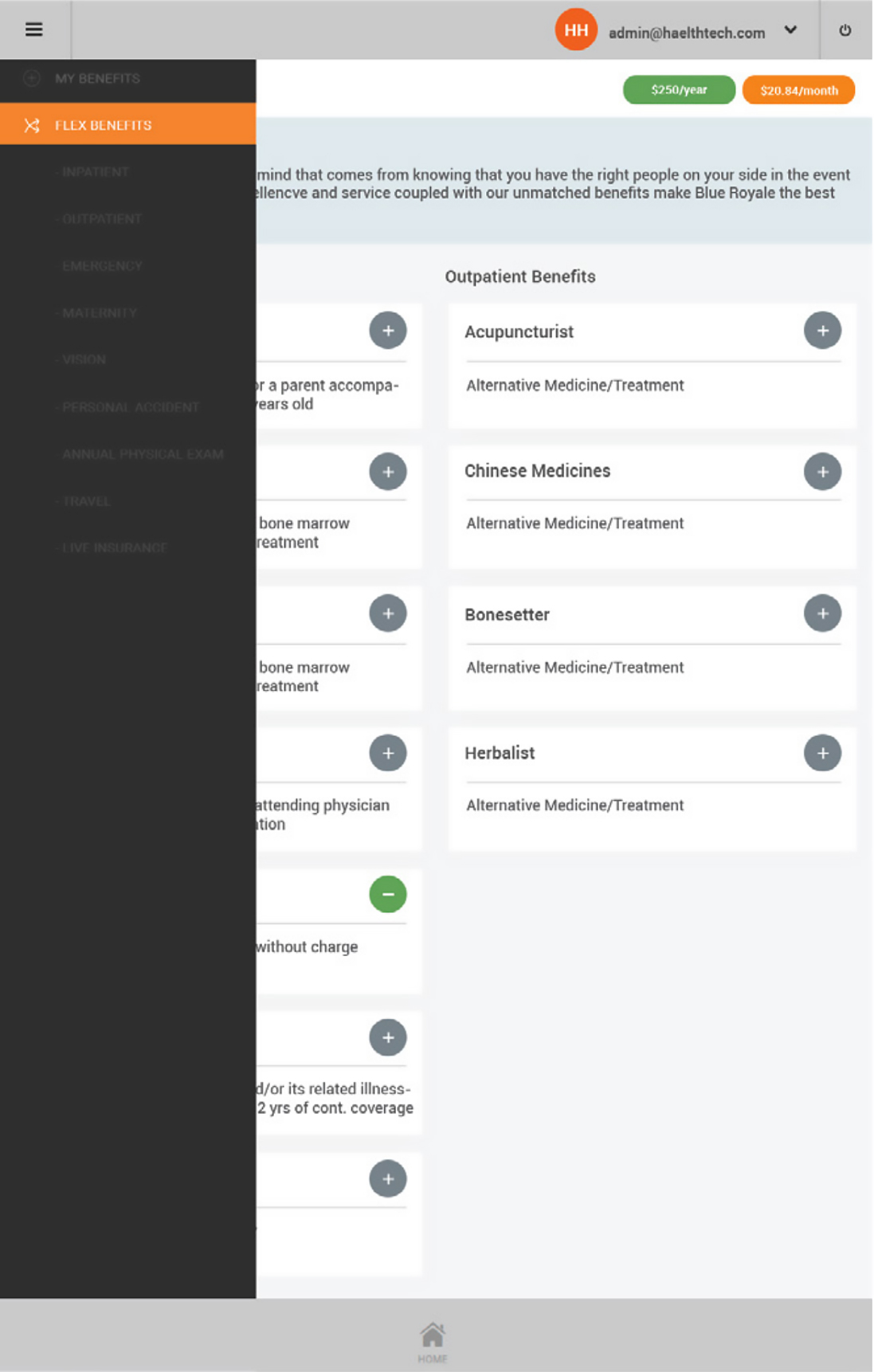

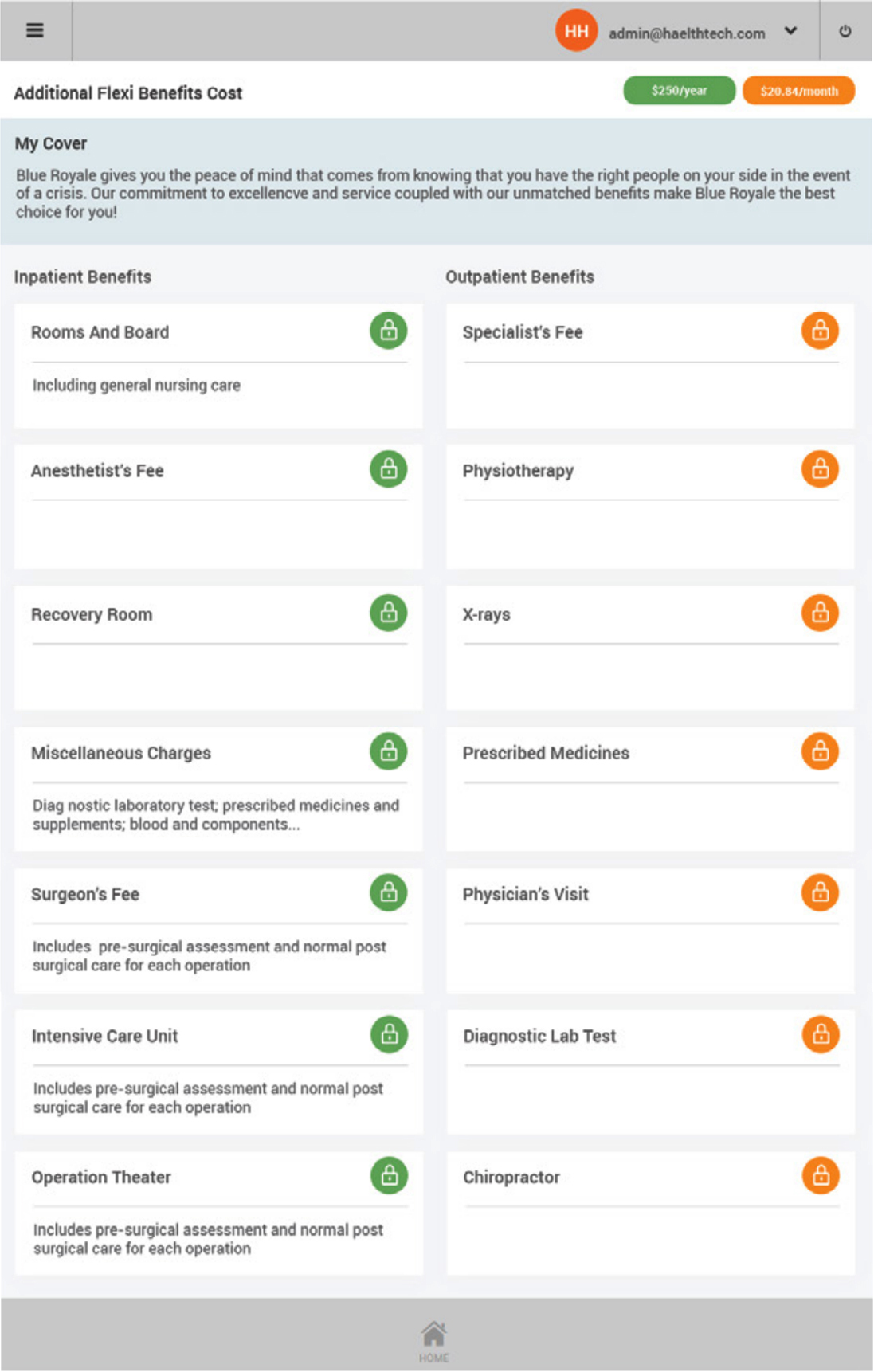

Benefits & Products

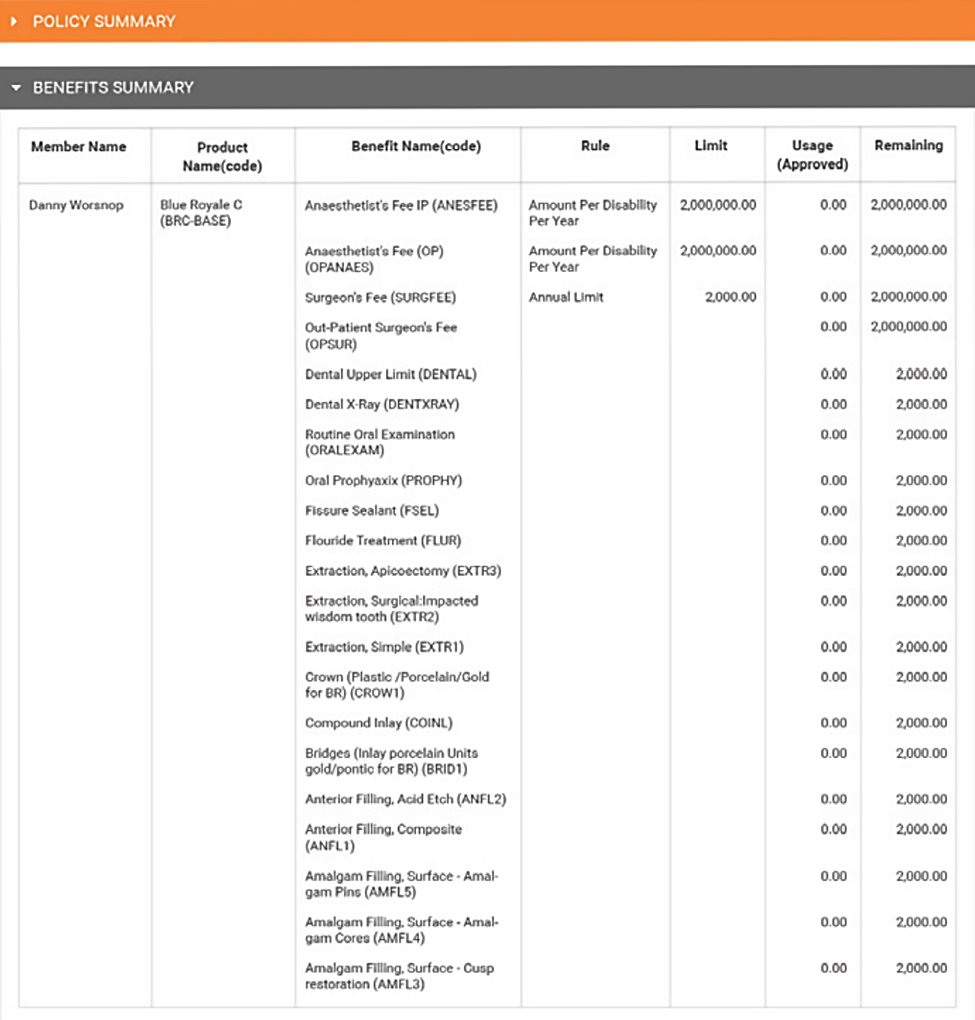

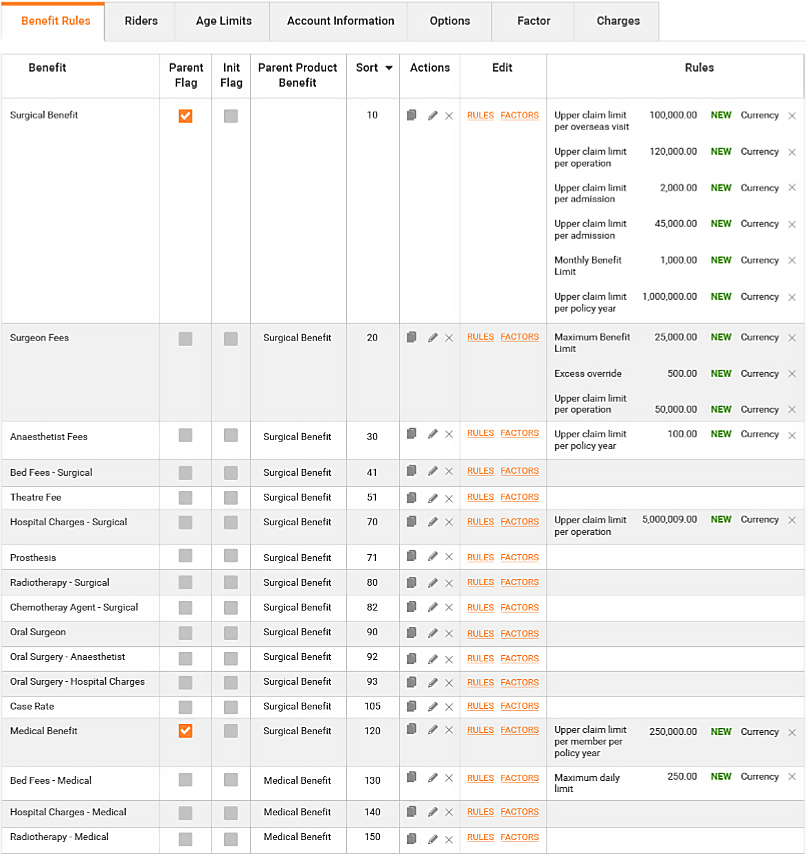

Omni allows complex products with base/rider product relationships to be defined by users literally in minutes.

Products are defined for a particular underwriter and defined set of benefits. Benefits have associated rules that drive the automated claims adjudication process and overall policy management process. Associated with each product or product option is a Rate Card that controls the premium calculation using premium factors such as date of birth or salary, or tabular rate concepts.

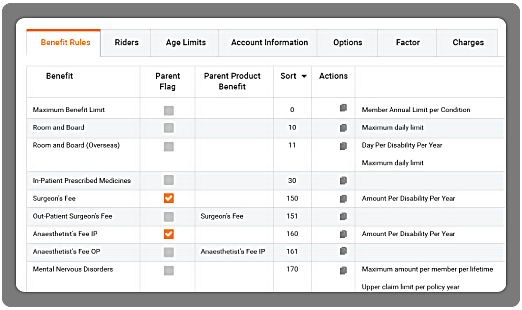

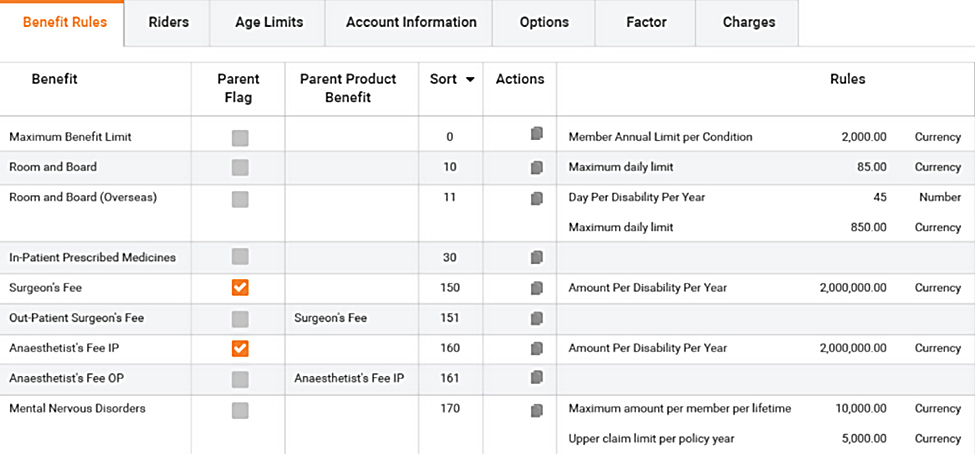

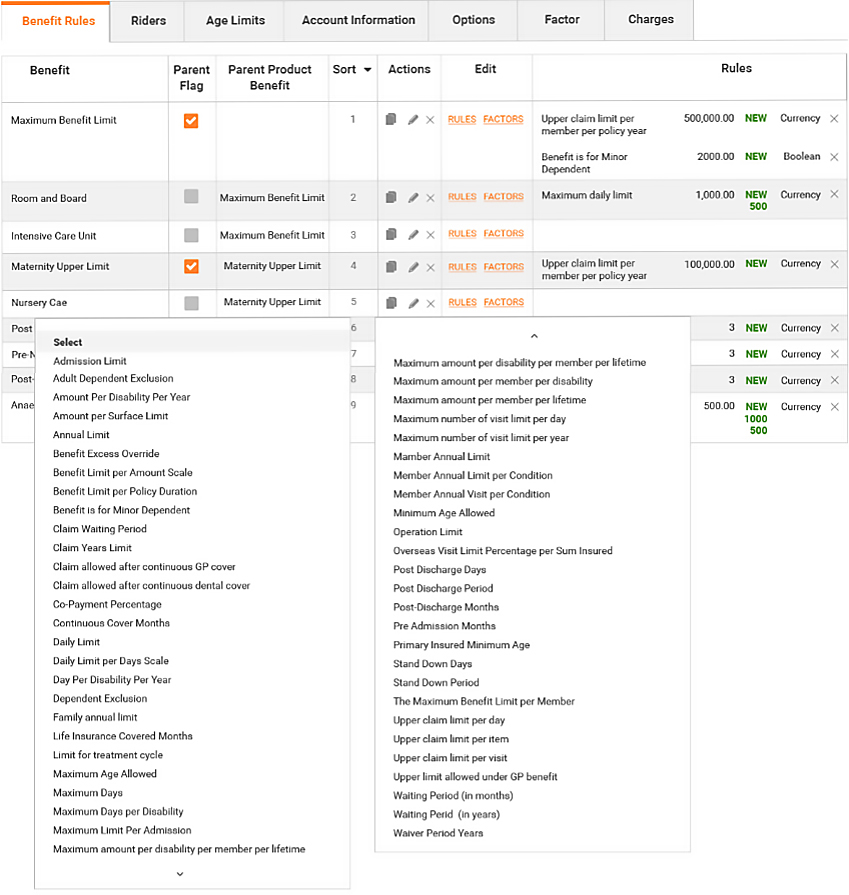

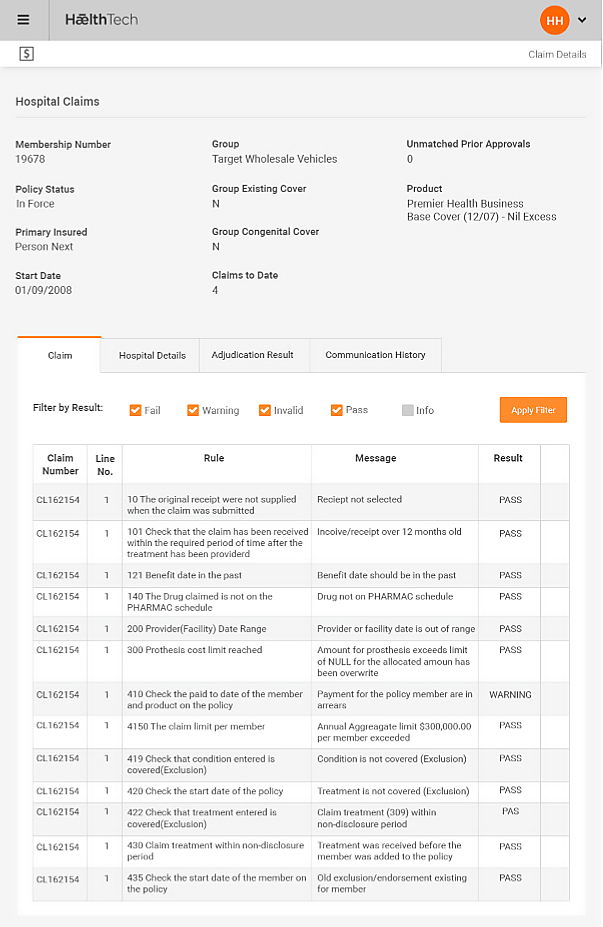

Rules Engine

Omni uses a dedicated rules engine to define benefits. Rules are assigned to benefits and allow for wide flexibilities in limits. Multiple rules may be applied to single benefits and the same rules applied to other benefits:

- Financial - benefit $ limits with inner and outer values e.g. limit per procedure, limit per annum, limit for policy lifetime

- Numeric e.g. number of doctor visits

Key Features

- Define products and benefits for Health and Risk products (Life, Income, Trauma, TPD...)

- Define multiple benefits types

- Define benefits and adjudication rules

- Link clinical code sets to benefits

- Assign Relationships between products and benefits

- Create base and rider products and product bundles

- Assign different (excess) options to products

- Assign underwriters to products

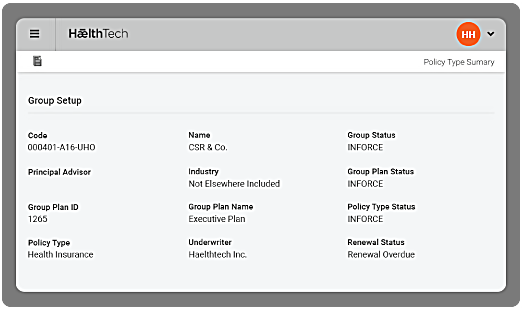

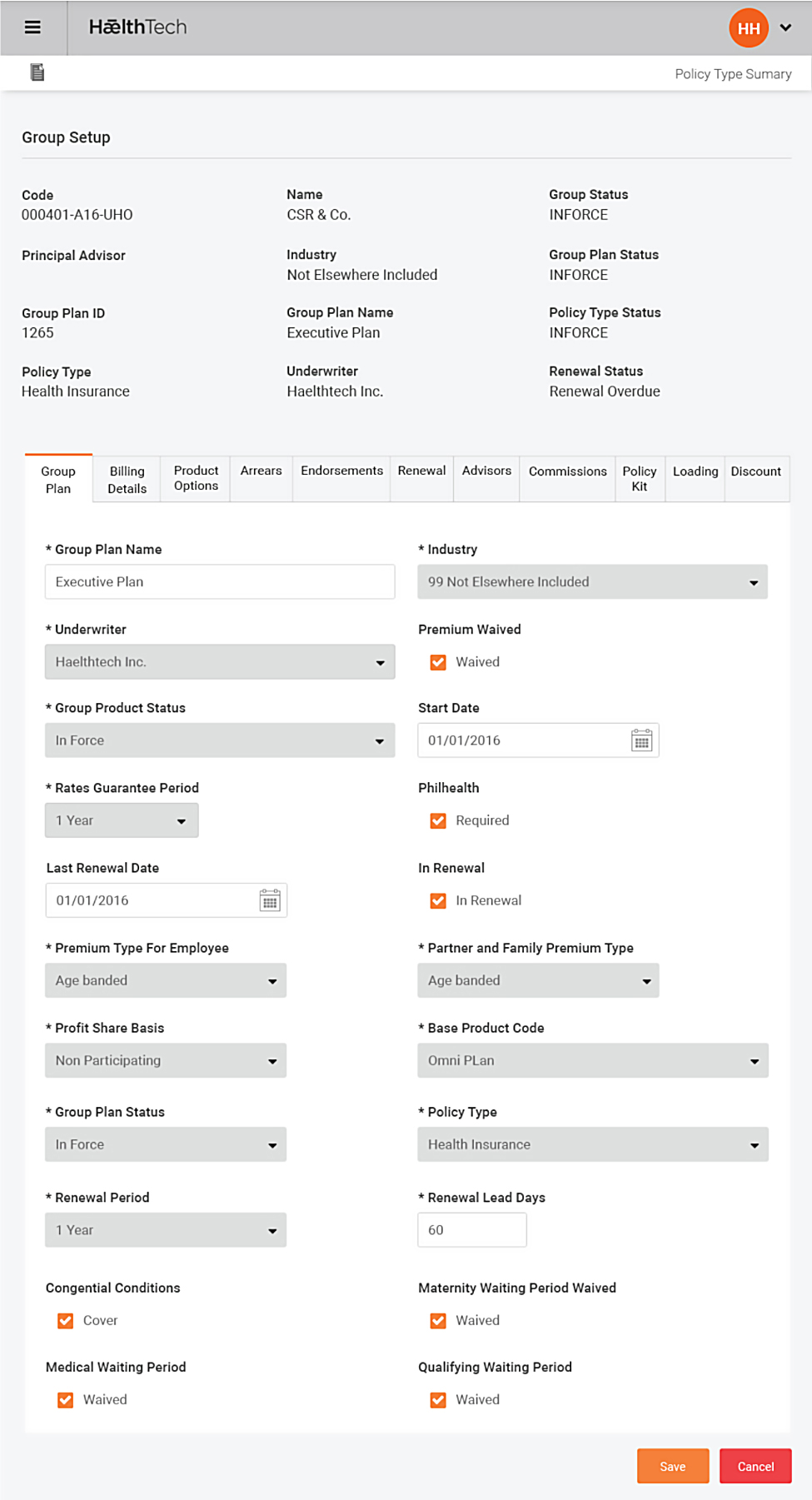

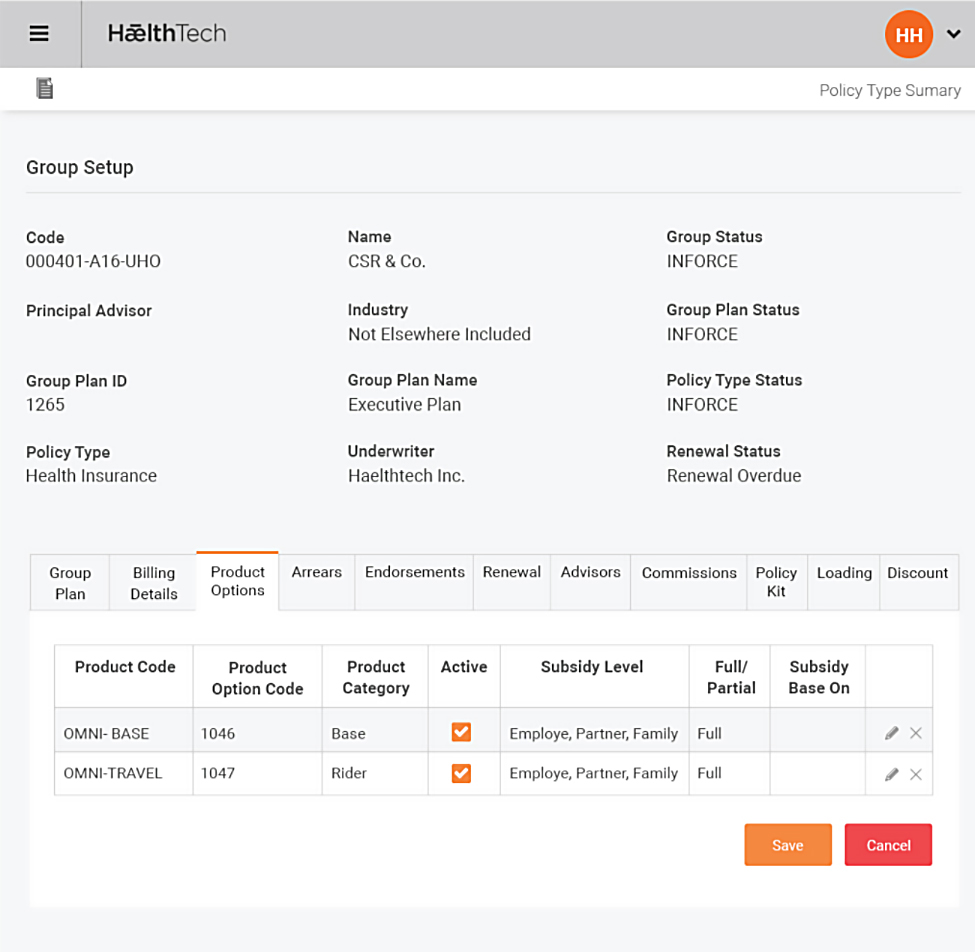

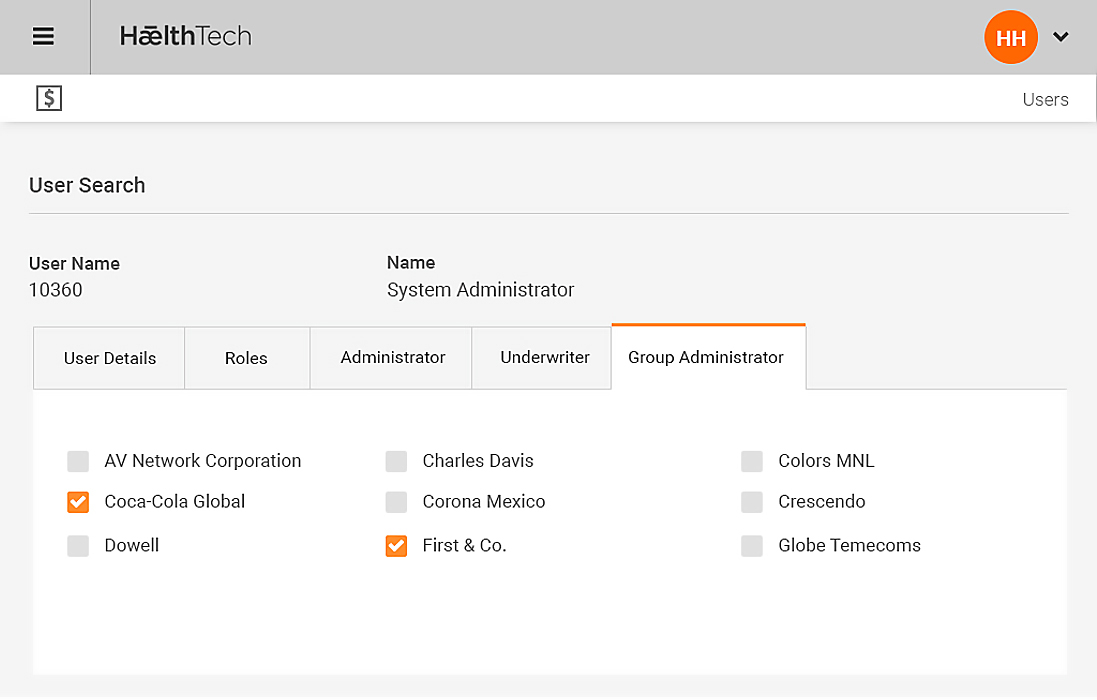

Groups & Group Plans

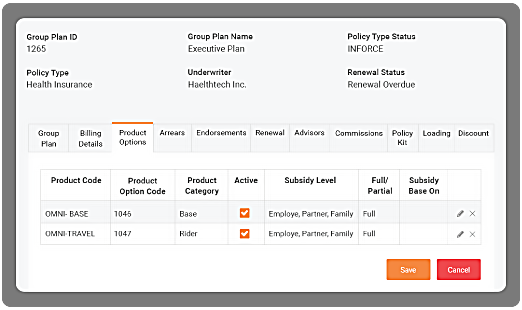

Omni Group and Group plan model allows either single or bundles of a base/rider products from diferent underwriters can be offered to a Group. Different products are placed in Group plans and offered to members of the Group. Omni contains a flexible structure allowing the breakdown of a group into plans, and further into the internal divisions (or business units) of the Group to assist in the billing and cash match of premium received from the Group or member, primarily by payroll deduction or direct debit agreements. During Group plan establishment, all member details may be loaded into Omni using a standard Policy Upload interface to automatically create all policies and calculate the initial installment and annualised premium per policy.

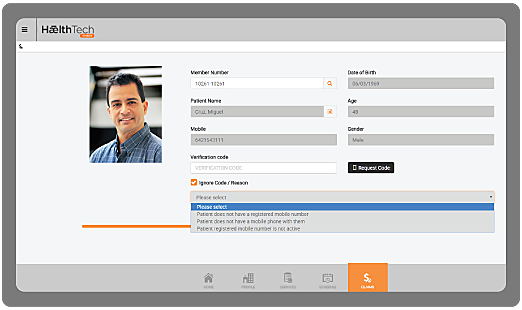

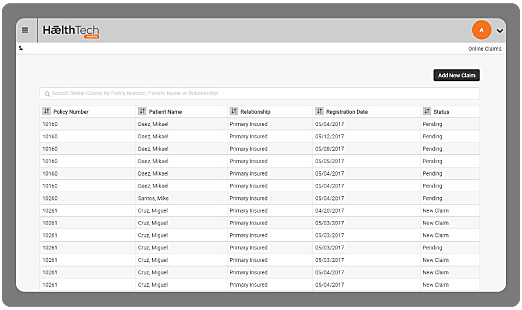

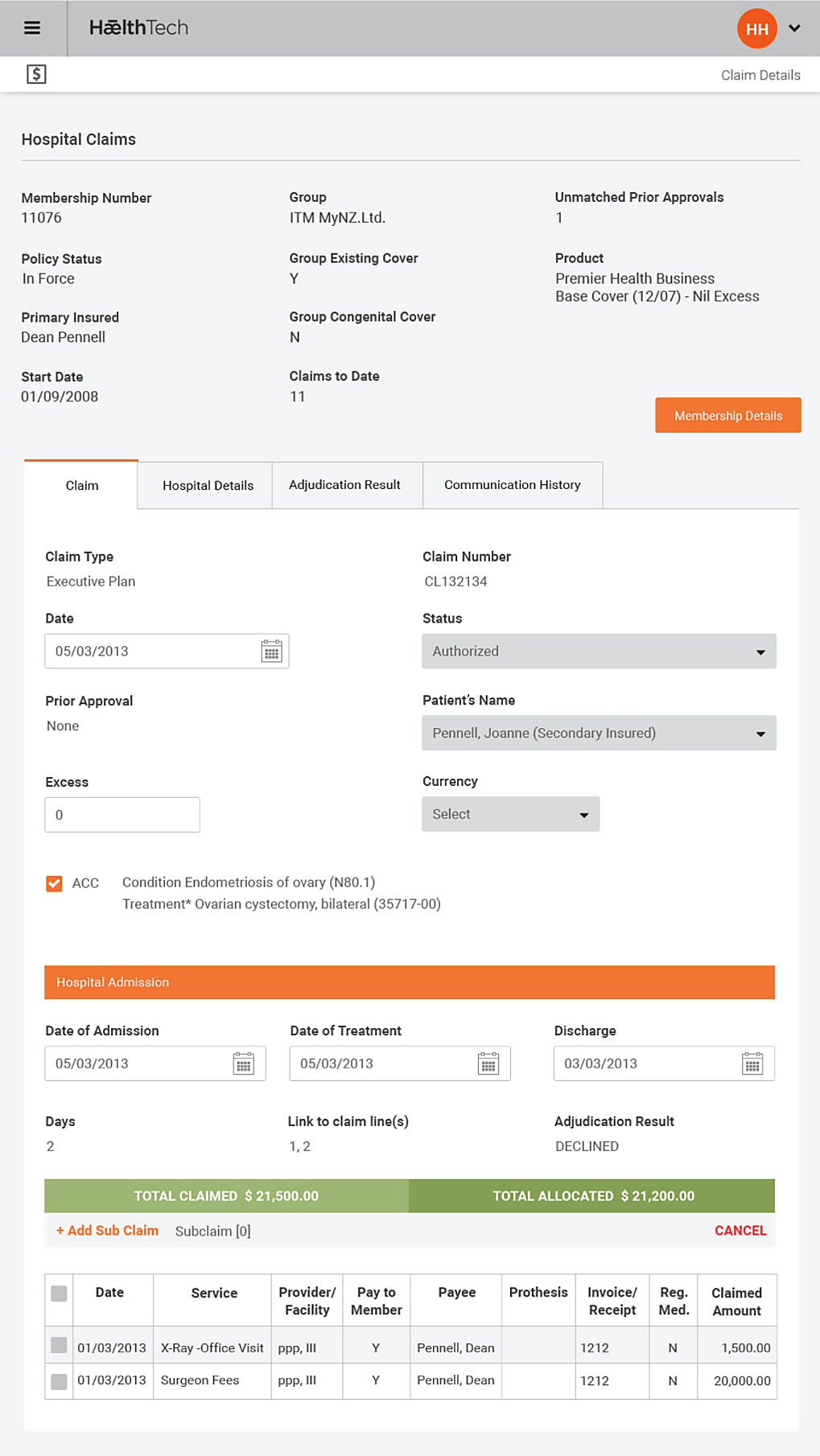

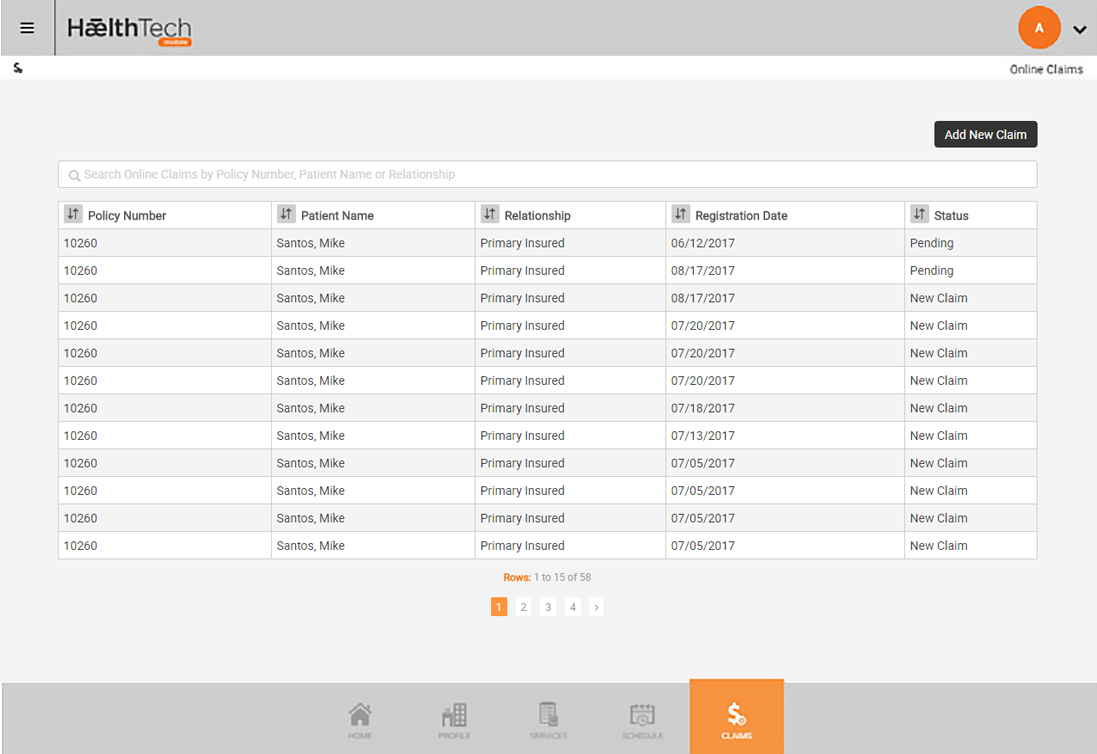

Policy Administration

Once the Group and plans are in force, Omni allows the administrator to use a number of screens to update member and policy information online with a detailed audit being maintained.

Policy maintenance includes simple updates like address and contact information, through to more complex options like updating the member’s billing and receipt details, or banking details for claim payments and direct debit receipts. Many updates can affect the premium, such as adding or removing members, changing the product option, or changing factors that directly affect the premium calculation such as date of birth, salary or smoker status. All updates that affect premium can be backdated.

Key Features

- Define Groups, divisions and locations

- Define Group contacts and advisors

- Define start and next renewal dates for groups and plans

- Link Group plans with products and product bundles

- Define Group plan subsidy levels, and how both subsidised and unsubsidised portions will be paid

- Assign premium calculation methods, billing methods and frequency to a Group plan

- Assign valid product (excess) options per plan

- Place plans in force, print welcome letters and acceptance certificates

- Multi-step group renewal process and premium recalculation

Key Features

- Define products and benefits for Health, Travel and Risk products (Life, Income, Trauma, TPD...)

- Define multiple benefits types

- Define benefits and adjudication rules

- Define multi-level hierarchies of clinical codes

- Link clinical code sets to benefits

- Assign Relationships between products and benefits

- Create base and rider products and product bundles

- Assign different (excess) options to products

- Assign underwriters to products

- Assign underwriter and administrator rate cards to products

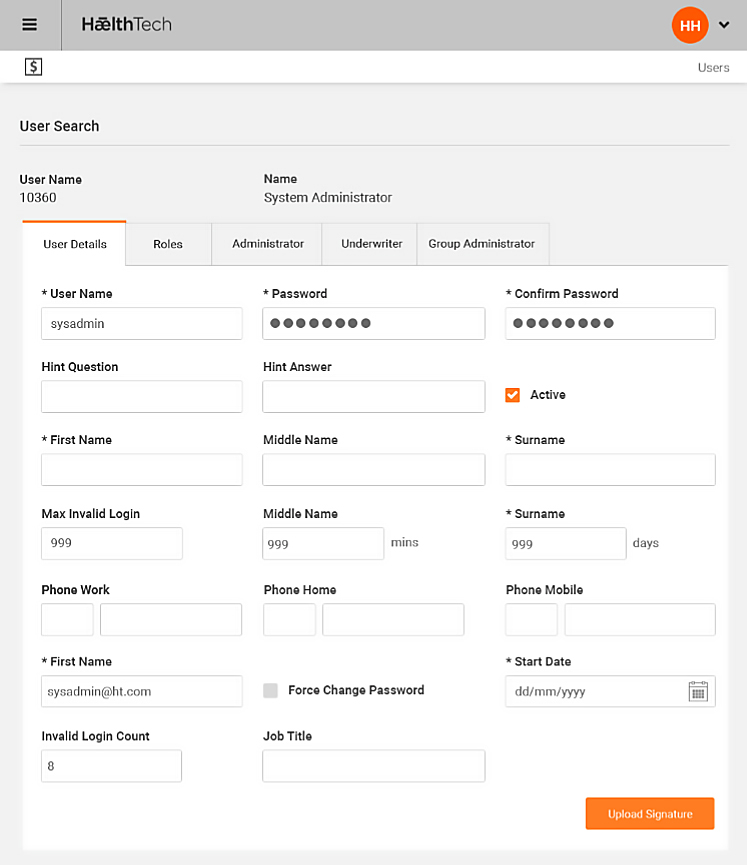

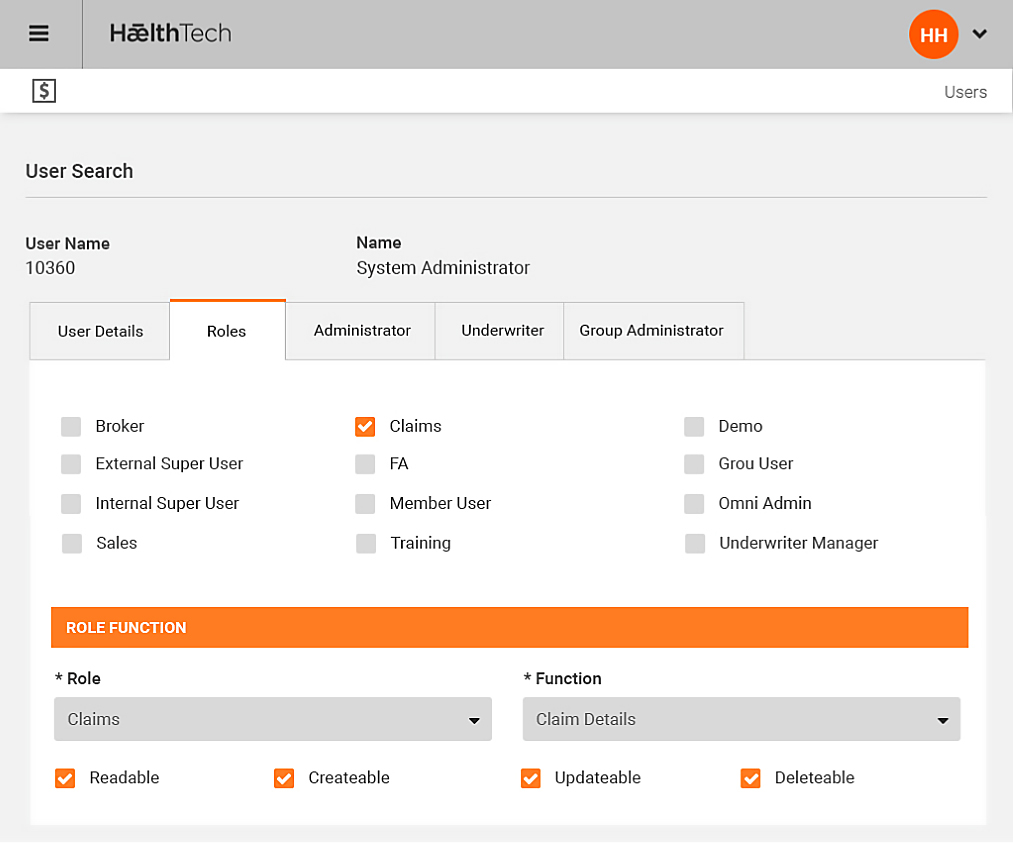

Underwriting

The Omni system supports multiple underwriters, and for different products to be de ned per underwriter. Various controls and information can be provided to each underwriter within tight data security that is limited to only that underwriter. A set of parallel accounting is generated online within Omni for both the administrator and each underwriter using the underwriter’s own general ledger account codes. Various accounting and other extracts or reports may be requested by the underwriter logging onto Omni over the internet via a secure layer. Omni allows online access to information such as claims monitoring, and the ability for the underwriter to make certain pre-agreed authorisations, such as payment of claims.