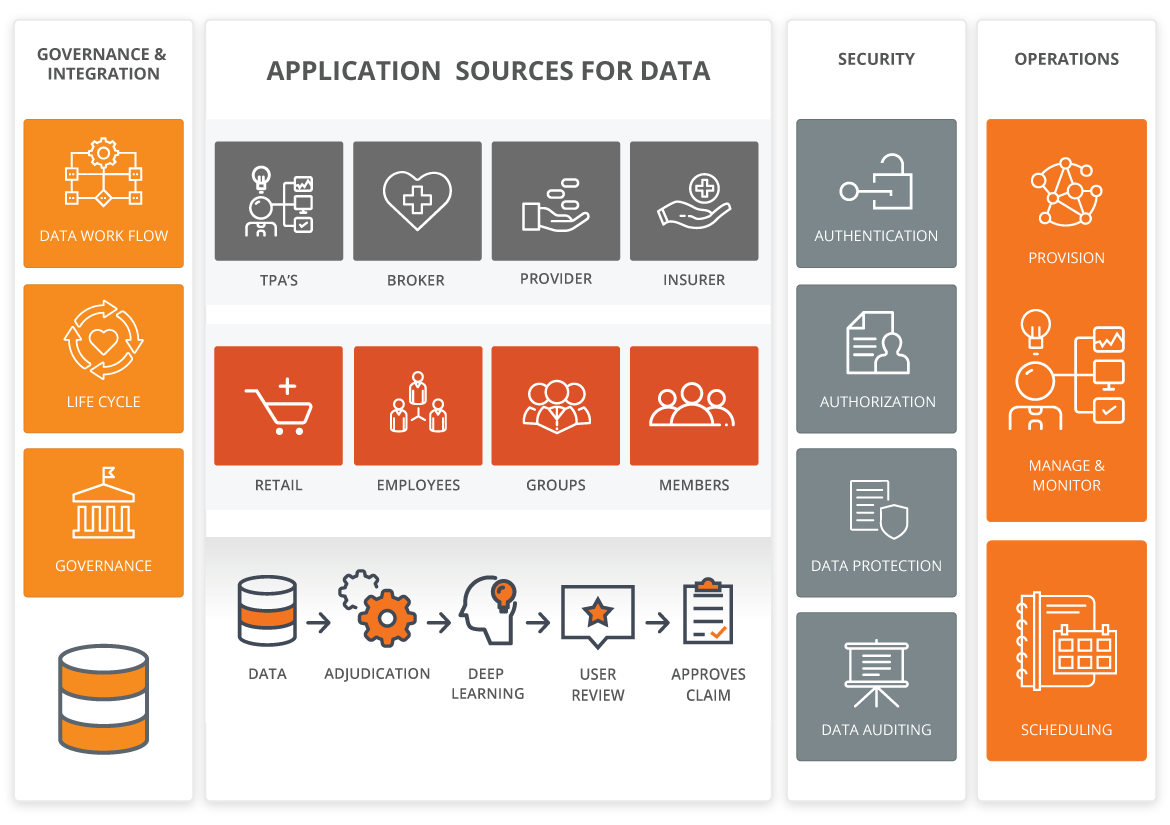

Solutions

Conventional software has limitations. It solves problems using fixed rules that require manual intervention to improve — it can’t handle ambiguity or changes in meaning. But our world is always changing and Healthcare issues do not obey rigid rules or static software. Our Solutions are different HǣlthTech derives knowledge by merging computational logic with an understanding of context. And, most uniquely, our technology learns, and grows smarter over time.

Innovative Approach to Health Insurance

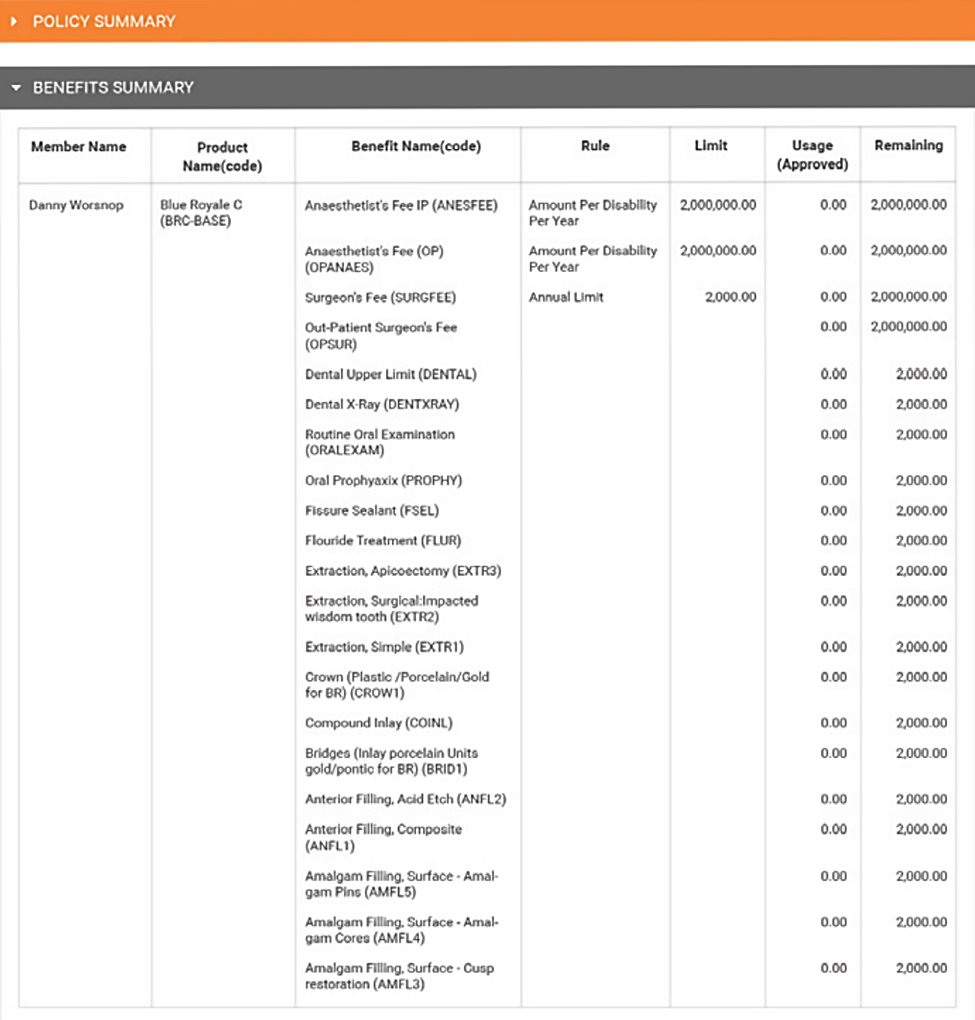

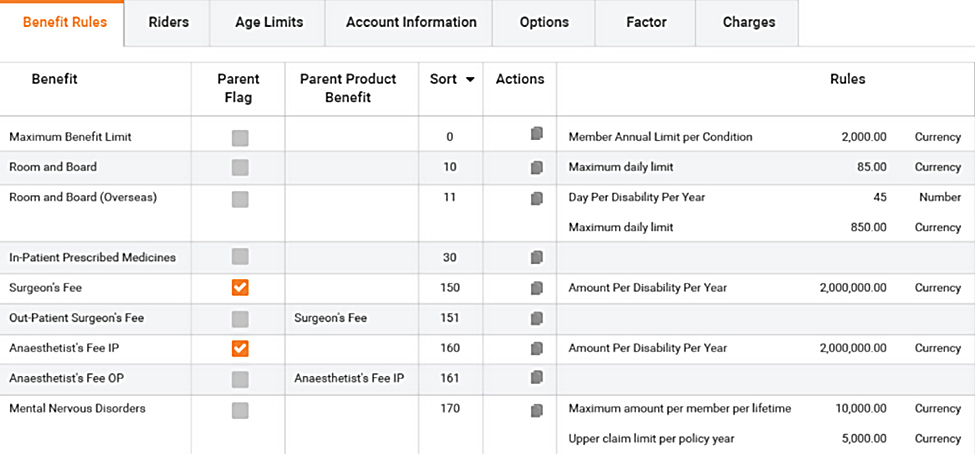

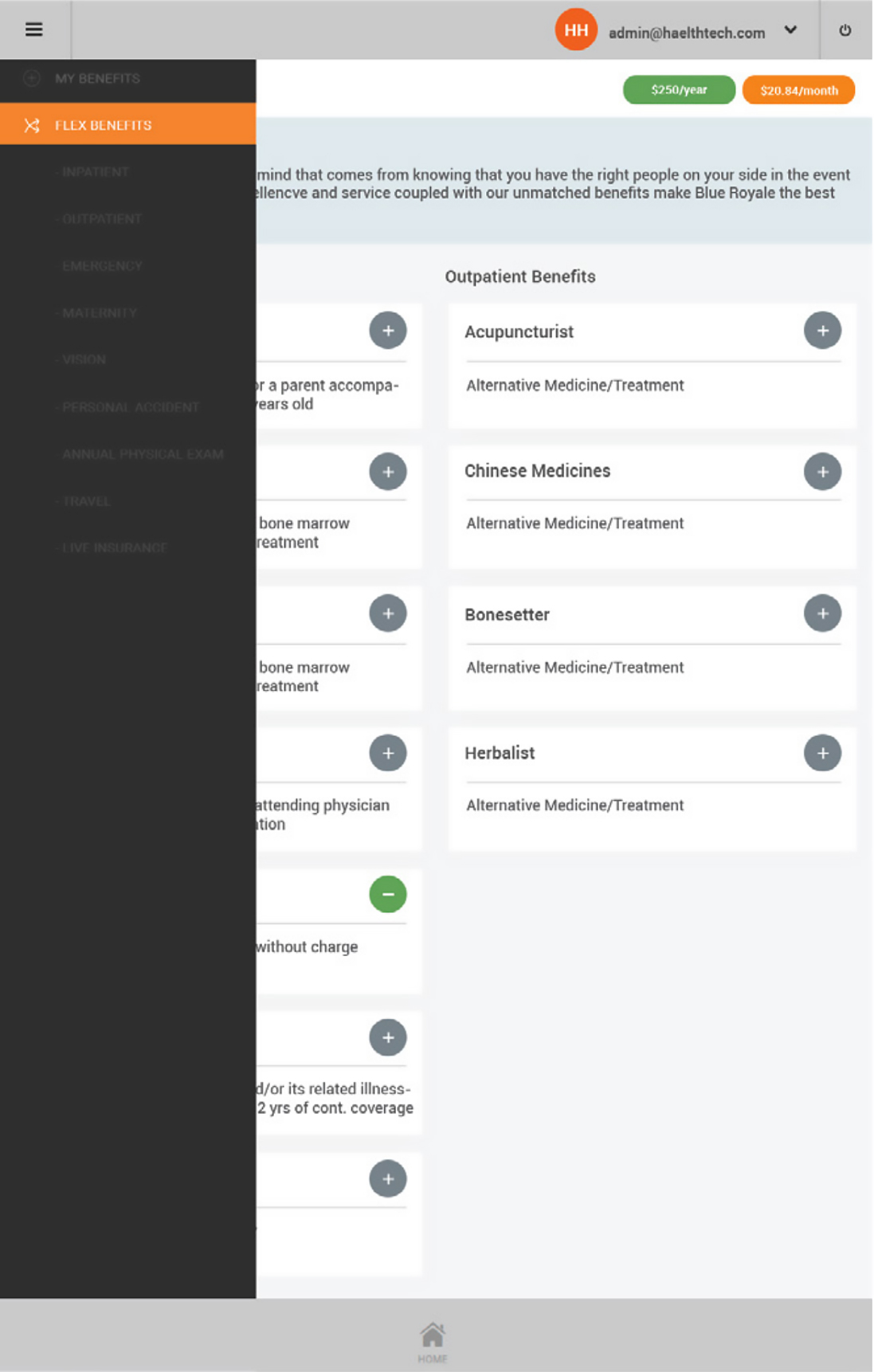

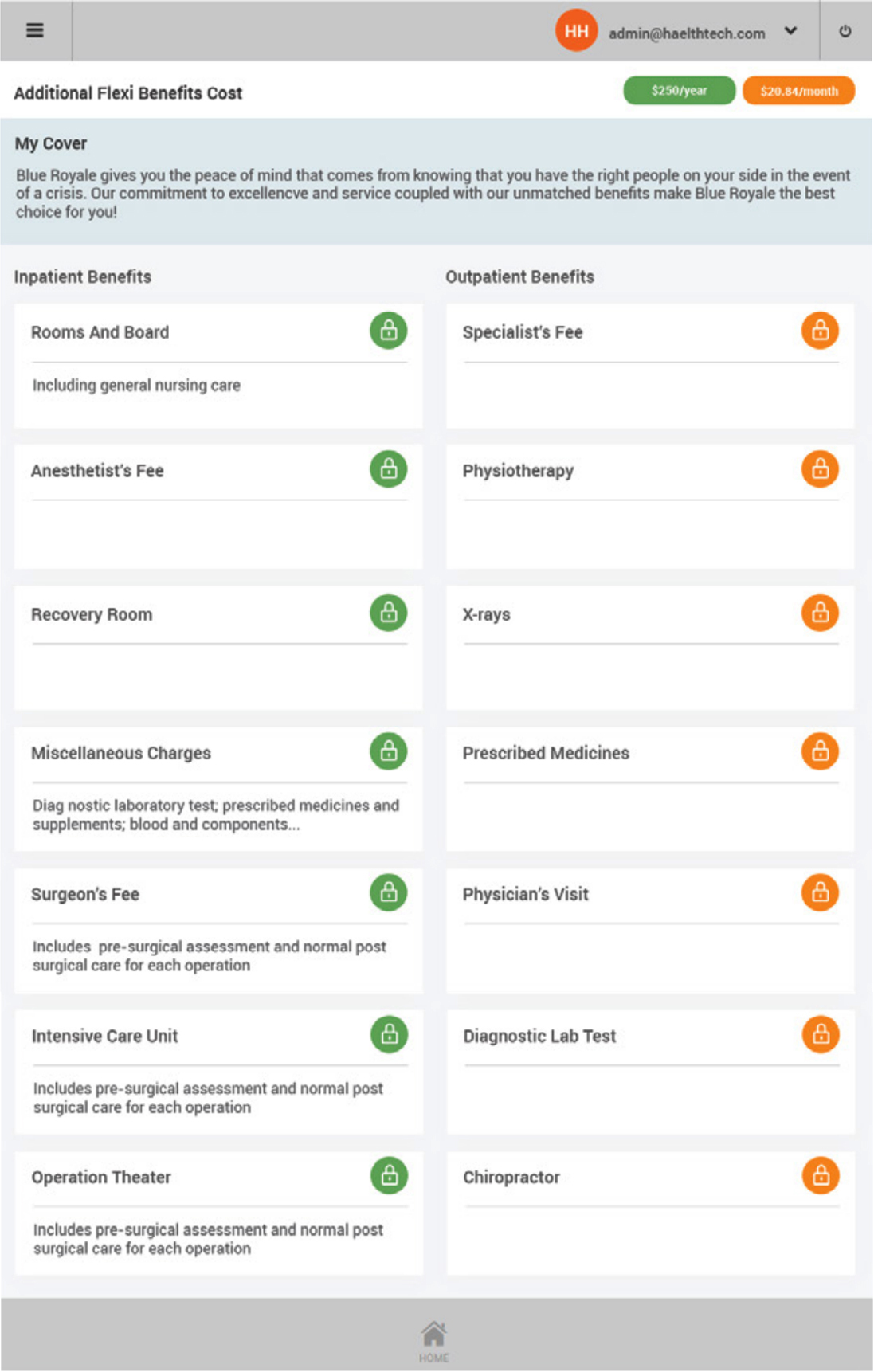

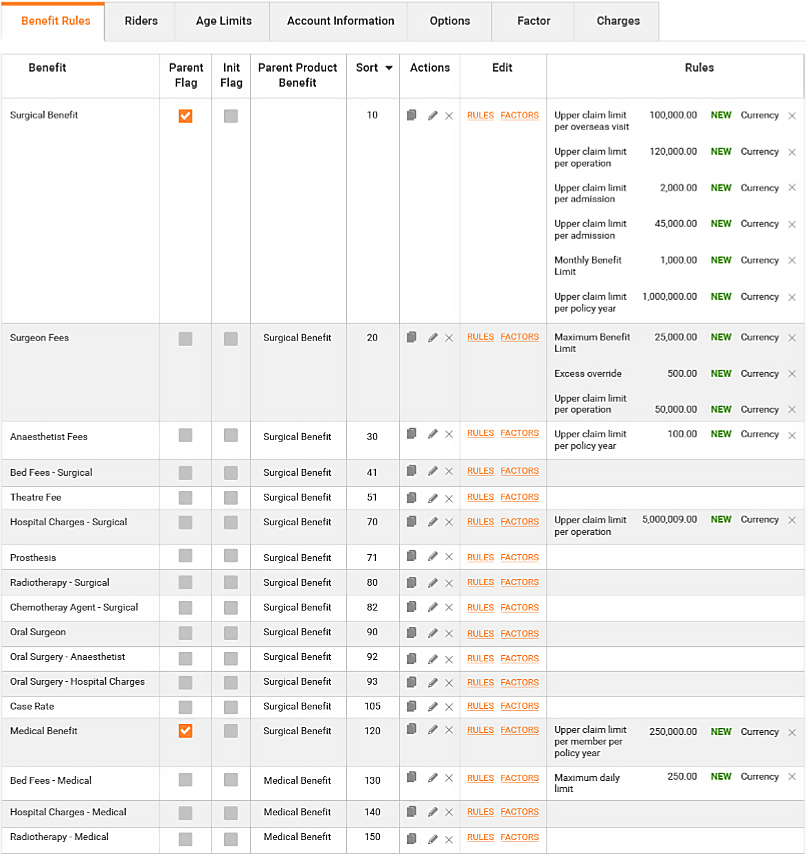

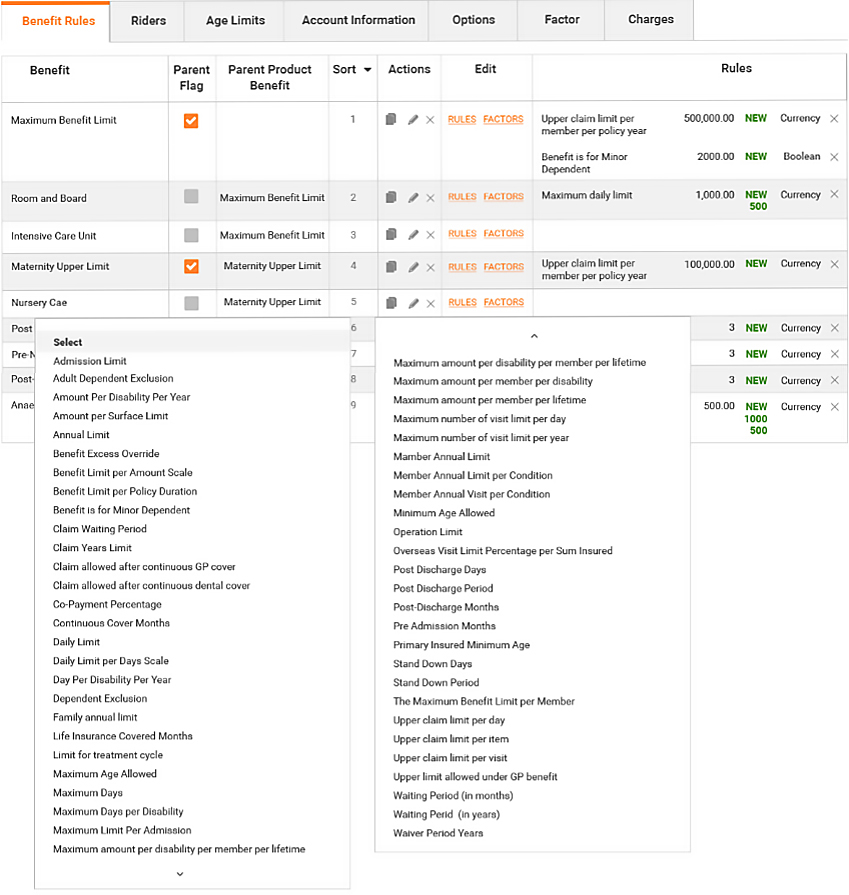

Benefits and Product Management

“The HǣlthTech cycle starts with product and benefit establishment. Complex products with base/rider product relationships that can be defined by users. Products are defined for a particular underwriter and a defined set of benefits. Benefits have associated rules that drive the automated claims adjudication process and overall policy management process. Associated with each product or product option is a rate card that controls the premium calculation using premium factors such as date of birth or salary, or tabular rate concepts”

Key Features

- Define products and benefits for Health and Risk products (Life, Income, Trauma, TPD...)

- Define multiple benefit types

- Define multi-level hierarchies of clinical codes<

- Link clinical code sets to benefits

- Assign relationships between products and benefits

- Assign different (excess) options to products<

- Assign underwriters to products

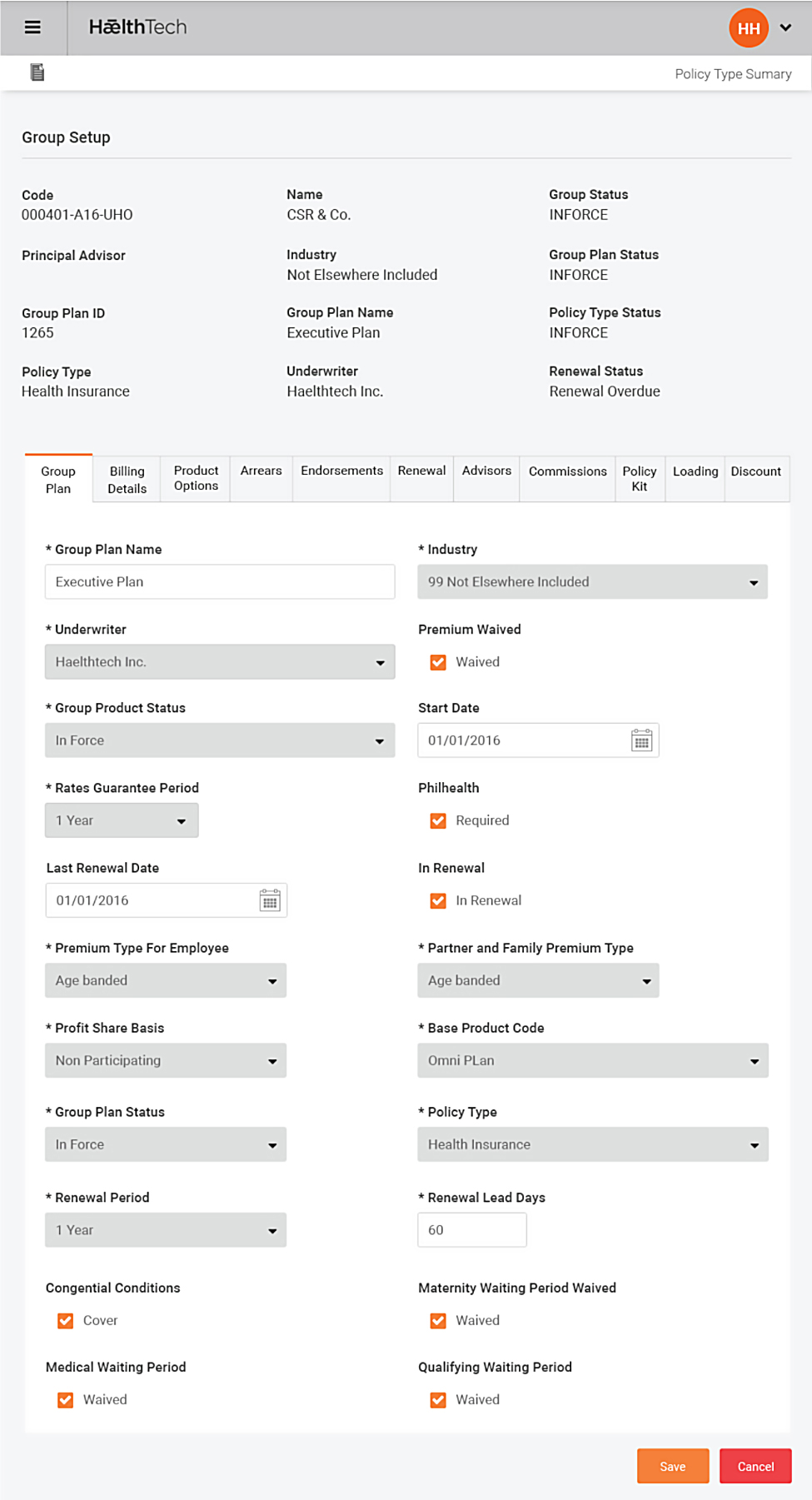

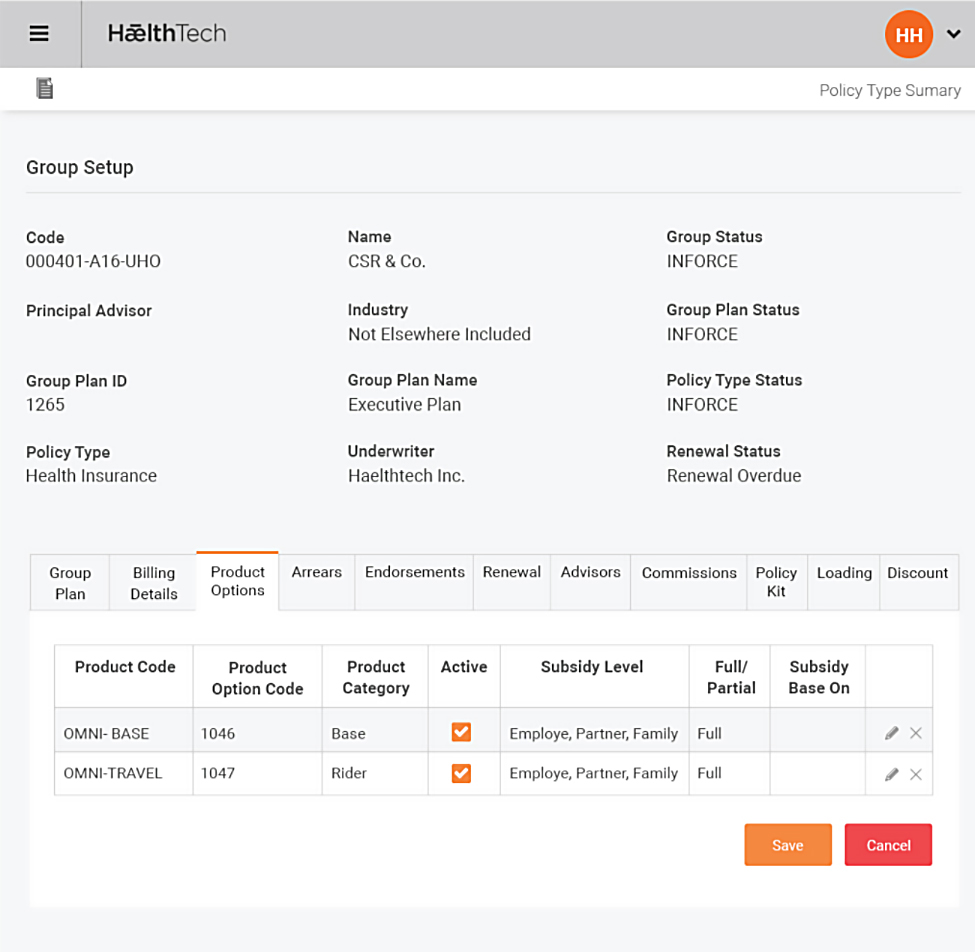

Group Set Up and Plan Establishment

“The HǣlthTech group and group plan model allows either single or bundles of a base/rider products from different underwriters can be offered to a group. Different products are placed in group plans and offered to members of the group. HǣlthTech contains a flexible structure allowing the breakdown of a group into plans, and further into the internal divisions (or business units) of the group to assist in the billing and cash match of premium received from the group or member, primarily by payroll deduction or direct debit agreements. During group plan establishment, all member details may be loaded into HǣlthTech using a standard Policy Upload interface to automatically create all policies and calculate the initial installment and annualized premium per policy”

Key Features

- Define groups, divisions and locations

- Define group contacts and advisors

- Define start and next renewal dates for groups and plans

- Link group plans with products and product bundles

- Define group plan subsidy levels, and how both subsidized and unsubsidized portions will be paid

- Assign premium calculation methods, billing methods and frequency to a group plan

- Assign valid product (excess) options per plan

- Place plans in force, print welcome letters and acceptance certificates

- Multi-step group renewal process and premium recalculation

Policy Administration

“Once the group and plans are in force, HǣlthTech allows the administrator to use a number of screens to update member and policy information online with a detailed audit being maintained. Policy maintenance includes simple updates like address and contact information, through to more complex options like updating the member’s billing and receipt details, or banking details for claim payments and direct debit receipts. Many updates can affect the premium, such as adding or removing members, changing the product option, or changing factors that directly affect the premium calculation such as date of birth, salary or smoker status. All updates that affect premium can be backdated.”

Key Features

- Define products and benefits for Health and Risk products (Life, Income, Trauma, TPD...)

- Define multiple benefit types

- Define benefits and adjudication rules

- Define multi-level hierarchies of clinical codes

- Link clinical code sets to benefits

- Assign relationships between products and benefits

- Create base and rider products and product bundles

- Assign different (excess) options to products

- Assign underwriters to products

Underwriting

“The HǣlthTech system supports multiple underwriters, and for different products to be de ned per underwriter. Various controls and information can be provided to each underwriter within tight data security that is limited to only that underwriter. A set of parallel accounting is generated on-line within HǣlthTech for both the administrator and each underwriter, using the underwriter’s own general ledger account codes. Various accounting and other extracts or reports may be requested by the underwriter logging onto HǣlthTech over the internet via a secure layer. HǣlthTech allows online access to information such as claims monitoring, and the ability for the underwriter to make certain pre-agreed authorizations, such as payment of claims.”

Key Features

- Handles multiple underwriters in a single instance

- Define unlimited products per underwriter

- Define product bundles spanning multiple underwriters

- Underwriter database includes payment details, contacts, account codes, occupation classes

- Run and download accounting extracts on-line

- Download a period data warehouse extract on-line

- Review prior-approvals, claims and medical invoices

- Authorize prior-approvals, claims, claims payments and medical invoices

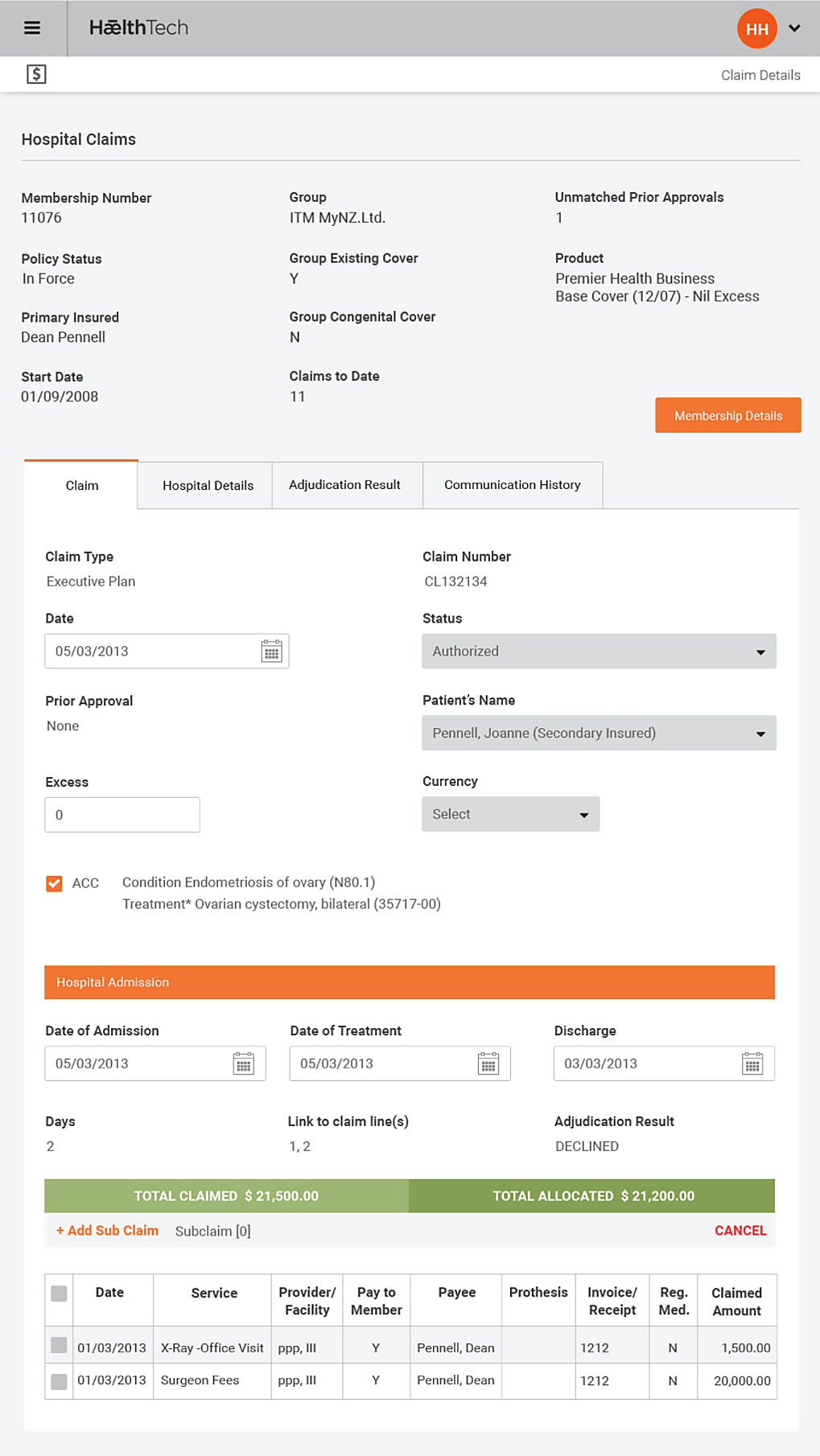

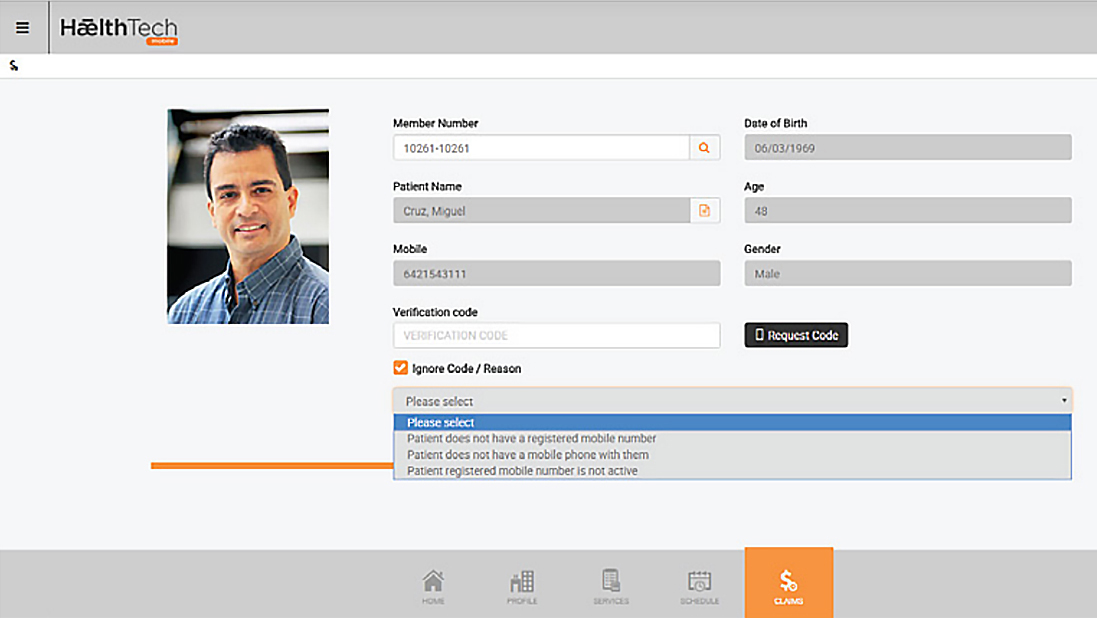

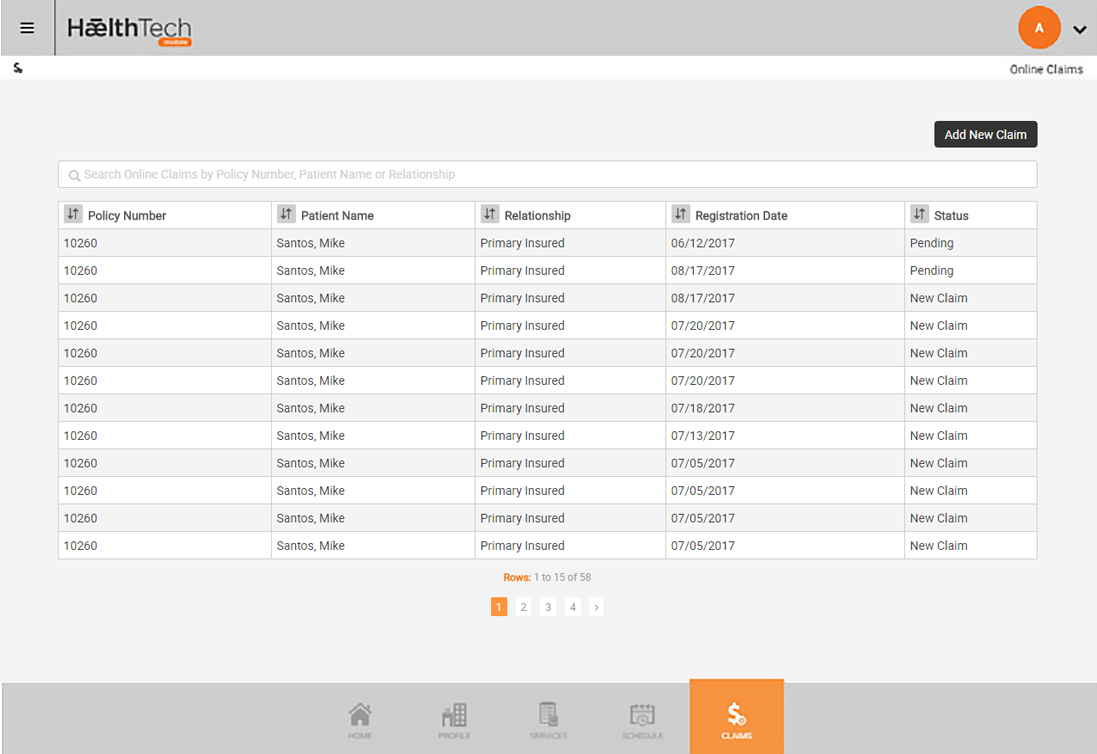

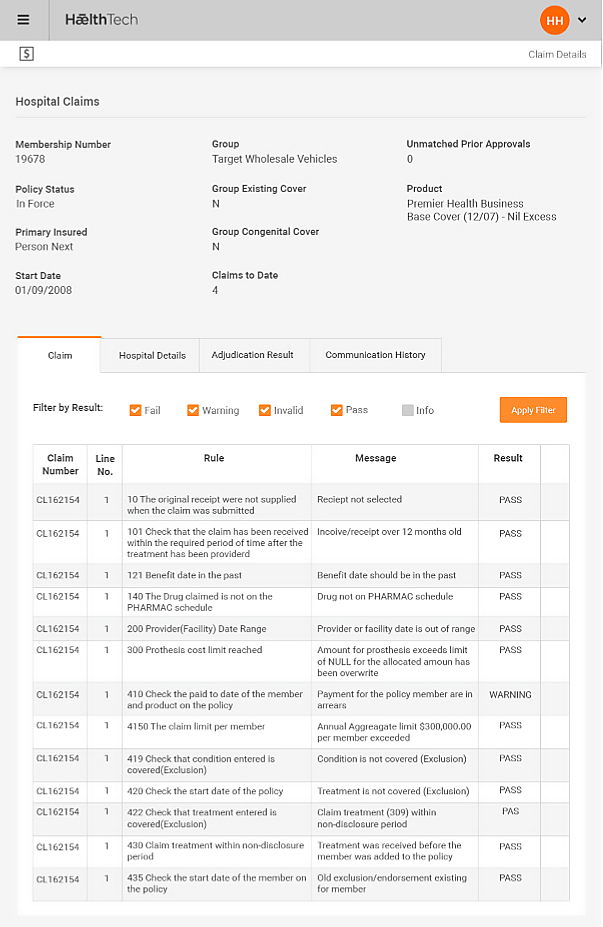

Claims Management

“Claims and Prior Approvals are managed within HǣlthTech for hospital and primary care claims. A claim can automatically be generated from an authorized Prior Approval. Multiple claims can be linked together so that grouping of treatments can be made even though a number of claims are submitted over a period of time. Each claim and prior approval must step through an adjudication process where the HǣlthTech system performs a series of checks using a rules based engine.”

Key Features

- On-line Prior Approvals

- Letters of guarantee

- Rules based electronic claims adjudication and underwriting process to ensure absolute consistency and accuracy in claims process

- Hospital and primary healthcare claims entry, rule-based adjudication process, approval and underwriter authorizations

- Medical invoice entry, approval, and underwriter authorizations

Premium Calculation and Accounting

“For each member in a group and product (excess) option HǣlthTech calculates the total premium, tax, installments and risk portion based on member demographics using a list of rate cards for products and underwriters. HǣlthTech supplies a powerful billing tool with flexibility to cover various premium rates, billing frequencies from weekly up to annual billing. After the billing has been run to raise premiums, direct debits can automatically be created, or in the case of direct credits or cheque payments, these may be entered and then matched automatically against the premium raised through either matching against the installments premium for the policy or a manual match at member product level.”

Premium Calculation Features

-

Multiple rate cards for underwriters and product options

-

Tabular and premium-factor based rate-cards available

-

Automatic premium calculation of premium and tax

-

Online premium recalculations within policy administration

Premium Accounting Features

- Raises premium at levels from groups to a single policy

- Includes a preview mode for user review and a final mode

- Creates tax invoices, group payment schedules, and premium to be collected by direct debit agreements

- Calculates credit billing, and credit/re-billing for retrospective changes to the policy and premium

- Optionally prorates the premium raised in a period for member or product change during a period